Introduction

Bitcoin mining began as a hobby for early adopters who mined coins from their bedrooms and garages. In 2009, each successful block earned the miner 50 BTC every 10 minutes. Those who held onto just one block reward from that era now hold approximately 5 million US dollars worth of Bitcoin in 2025.

Over the years, mining has evolved from a grassroots experiment into a multibillion-dollar global industry. Today, it is driven by professional equipment, industrial-scale operations, and highly competitive economics.

Key Highlights

- Bitcoin mining remains profitable in 2025, especially for professional miners.

- The industry generates over 20 million in daily revenue, or about 600 million per month.

- Mining equipment ranges from $2000 to $20000, limiting entry for casual miners.

What Is Bitcoin Mining

Bitcoin mining is the foundation of Bitcoin’s Proof-of-Work protocol. It secures the blockchain, validates transactions, and keeps the network decentralized.

Miners compete to solve mathematical puzzles. The first to solve it adds a new block to the blockchain and earns a reward in newly created Bitcoin, along with user transaction fees. This process occurs every 10 minutes regardless of how many machines participate.

Bitcoin Block Rewards and Halving

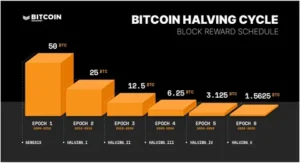

In April 2024, the Bitcoin network underwent its fourth halving. The block reward decreased from 6.25 BTC to 3.125 BTC. In 2028, it will halve again to 1.5625 BTC.

This built-in deflation schedule limits supply and increases long-term scarcity.

Understanding Network Difficulty

Network Difficulty adjusts automatically every 2016 blocks to keep block production at one every 10 minutes. As more miners join the network, the difficulty rises to maintain this pace.

The difficulty is determined by the total hashrate, or the combined computing power of all miners.

Mining Hardware and Efficiency

Modern mining relies on ASICs, or Application Specific Integrated Circuits. These machines are built solely for mining Bitcoin and are much more powerful than GPUs or CPUs.

Popular models like the Whatsminer M20S vary in price and performance. Efficient models consume less electricity while producing high output, improving profitability over time.

What Is Hashrate

Hashrate measures how many hash calculations a miner can perform each second. The higher the hashrate, the better the chance of earning a reward.

Hashrate units include:

- KH’s thousands of hashes

- MH’s millions of hashes

- GH’s billions of hashes

- These trillions of hashes

- PHs quadrillions of hashes

- EHs quintillions of hashes

By early 2025, the Bitcoin network’s hashrate had exceeded 85 EH/s, underscoring the immense scale of global mining.

Mining Revenue and Profitability

Mining income depends on the following factors:

- Bitcoin market price

- Network difficulty

- Hardware efficiency

- Electricity cost

For example, a Whatsminer M20S may generate around 0.0007 BTC daily. If Bitcoin trades at 70000, that equals about 49 per day before costs.

However, profitability hinges on your electricity rate. Mining is viable at 0.045 kWh, but becomes unprofitable at home rates of 0.12 kWh or more.

The Role of Mining Pools

Solo mining is impractical today. Instead, miners join pools to combine hashrate and share rewards more consistently.

Popular pools include:

- F2Pool

- Slush Pool

F2Pool uses a PPS Plus payout method. It pays miners daily based on the contributed hashrate, regardless of whether the pool finds a block that day.

Why Electricity Costs Matter

Electricity is the highest cost for miners. Industrial energy rates in China, Russia, and Kazakhstan are often below 0.05 kWh, enabling profits. In contrast, miners in places with high residential rates may operate at a loss.

Some miners reduce costs by capturing waste energy sources like flare gas or co-locating near hydroelectric power.

Professional Miners vs Home Miners

Large-scale operations benefit from lower costs, better hardware, and discounted electricity. They also access better deals when selling Bitcoin.

Home miners face higher costs and limited options. For many individuals, simply buying and holding Bitcoin may offer a better return.

Tax Implications of Mining

Mining earnings are typically considered taxable income. Miners must track their rewards, costs, and equipment depreciation. Using specialized tax software is strongly recommended to stay compliant and profitable.

Can You Still Make Money Mining

Yes, but only under the right conditions. To mine profitably, you need:

- High efficiency hardware

- Cheap and stable electricity

- A reliable mining pool

- Low selling fees or access to over-the-counter trading

Mining calculators can help determine your expected profits based on these inputs.

Mining Pools and Earnings

Mining pools calculate your daily earnings based on your machine’s hashrate compared to the total network hashrate. If the network is at 85 EHs, and you have a miner producing 68 THs, you might earn around 0.0007 BTC per day. After pool fees, your net earnings would be slightly less.

At 70000, that would equal around 47.88 per day.

Is Bitcoin mining still profitable in 2025?

Yes, but mainly for miners with access to cheap electricity and efficient hardware.

How often is a Bitcoin block mined?

Approximately every 10 minutes.

What is the current Bitcoin block reward?

3.125 BTC per block.

What is an ASIC miner?

A specialized computer designed specifically for mining Bitcoin.

Why is the cost important in mining?

Electricity is the largest ongoing expense and directly affects profitability.

Can individuals still mine Bitcoin at home?

Technically, yes, but it’s usually unprofitable due to high costs.

What is hashrate?

A measure of a miner’s computing power in solving cryptographic puzzles.

What is a mining pool?

A group of miners who combine their hashrate to share block rewards more consistently.

How does Bitcoin halving affect miners?

It reduces the block reward, making it harder to earn the same amount of Bitcoin.

Do miners have to pay taxes?

Yes, mining income is usually taxable and should be reported accurately.

Final Thoughts on the Future of Mining

Bitcoin mining has grown into a global business with tight margins and high barriers to entry. For most individuals, it is no longer practical to mine from home. However, with access to affordable power and efficient machines, mining remains a potentially profitable venture.

As the industry matures, we may see a return of small-scale mining if ASIC innovation slows down and energy access becomes more decentralized and affordable.

Restoring mining access to individual users would also support the original decentralized vision of Bitcoin.