Introduction

The financial landscape has undergone rapid transformation in recent years, and one of the most notable changes has been the rise of Buy Now, Pay Later BNPL services. BNPL allows consumers to purchase items upfront and pay for them in installments, offering greater financial flexibility and immediate gratification. What started as a niche offering for online shoppers has now become a mainstream financial trend, with BNPL providers like Klarna, After pay, and Affirm leading the charge.

While BNPL is undeniably popular, its sustainability is an ongoing debate. Is this trend built to last, or is it a fleeting response to economic shifts in the short term? This article will delve into the rise of BNPL, examining its pros and cons, the factors driving its growth, and whether it can sustain its momentum as a long-term financial model.

Understanding Buy Now Pay Later

What is BNPL?

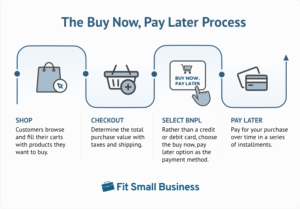

At its core, Buy Now, Pay Later BNPL is a service that allows consumers to make purchases and pay for them in installments. Typically, these services divide the total cost of a purchase into smaller, interest free payments spread out over a period, usually ranging from a few weeks to a few months. While interest is often waived for customers who pay on time, late fees can apply, making this an attractive but potentially risky financial option.

Some of the most popular BNPL providers include After pay, Klarna, Affirm, and Sezzle, which partner with both online and in-store retailers to offer customers this flexible payment option. These services do not usually require a credit check, which makes them accessible to younger generations and people who may not have access to traditional credit.

Key Features of BNPL Services

- Interest Free Periods: BNPL providers typically offer interest free repayment periods, provided the consumer adheres to the repayment schedule. This feature makes BNPL an attractive alternative to traditional credit cards.

- Flexible Payment Plans: Consumers can opt for various installment schedules, with some BNPL providers allowing customers to split payments into four equal installments or monthly payments.

- Accessibility: Unlike traditional financing options, BNPL services are widely accessible. Many providers do not require a credit score check, making it easier for people with less than perfect credit to use these services.

- Instant Credit Approval: Most BNPL services offer instant approval for purchases, with users simply needing to provide basic personal information. This speeds up the purchasing process compared to applying for a traditional loan or credit card.

How BNPL Differs from Traditional Credit Options

BNPL services differ from traditional credit options in several ways:

- No Credit Checks: While credit cards and loans typically require a credit check, BNPL services often bypass this requirement, making it more accessible to a wider demographic, including younger consumers.

- Short Term Loans: BNPL is designed for short term financing, typically offering repayment plans that range from a few weeks to a few months. Traditional credit cards and loans, on the other hand, offer long term repayment options.

- Lower Fees and Interest: Credit cards often carry higher interest rates and fees, particularly if users fail to make timely payments. BNPL, in contrast, usually provides interest free periods, though late fees can apply.

The Rapid Rise of Buy Now Pay Later

Growth in Popularity

The popularity of BNPL has soared in recent years, especially during the COVID 19 pandemic. With consumers stuck at home and facing financial uncertainties, BNPL services provided a way to continue shopping without immediate financial strain. The rise of E commerce and online shopping has also played a significant role in driving the growth of BNPL, with platforms like Amazon, Walmart, and Target embracing the payment method.

According to a report by Worldpay, BNPL transactions in North America grew by 230 percent in 2020 alone, reflecting the significant shift toward flexible payment methods. Additionally, the global BNPL market is projected to reach over $1 trillion by 2025, underscoring the increasing reliance on these services.

BNPL and the Millennial Consumer

BNPL services are particularly popular among millennials and Gen Z, who are more likely to prioritize experiences and immediate gratification over long term savings. These younger generations tend to view BNPL as an affordable and flexible way to make purchases without resorting to traditional credit options, which they may not have access to or may wish to avoid due to high interest rates.

For many consumers in their 20s and 30s, BNPL offers a level of convenience and transparency that traditional credit options do not. In fact, nearly 50 percent of BNPL users in the United States are aged between 18 and 34, according to a 2021 survey by Credit Karma.

Factors Driving BNPL’s Popularity

Several factors have contributed to the explosive growth of BNPL:

- Economic Uncertainty: The global financial crisis brought about by the COVID 19 pandemic has made many consumers more cautious about their spending. BNPL services provide a way to purchase necessary items without committing to full upfront payment.

- Convenience: BNPL services integrate seamlessly with E commerce platforms, making it easier for consumers to choose BNPL at checkout. The instant approval and minimal paperwork add to the convenience factor.

- Retailer Partnerships: Retailers benefit from offering BNPL as it can help increase sales, boost average order value, and reduce cart abandonment rates. Major companies like H and M, Peloton, and Sephora now offer BNPL as a payment option.

The Business Perspective

Why Businesses are Adopting BNPL

For businesses, the adoption of BNPL offers several advantages. First, it drives consumer spending by allowing customers to spread out payments, thereby encouraging larger purchases. According to a study by After pay, retailers that offer BNPL options see a 20 to 30 percent increase in conversion rates, with the average order value rising by 40 percent.

Additionally, BNPL services help reduce cart abandonment, a common challenge faced by online retailers. By offering consumers the option to pay in installments, businesses can capture sales that would otherwise be lost at the checkout.

The Financial Model of BNPL Providers

BNPL providers primarily make money through merchant fees, which are typically a percentage of the transaction amount. These fees can range from 2 to 6 percent, depending on the provider and the agreement with the retailer. For the consumer, late payment fees and interest charges are additional sources of revenue for BNPL companies. However, many BNPL services emphasize that they make their money from merchant partnerships, rather than from consumers.

The Impact of BNPL on Traditional Credit Markets

BNPL services have disrupted the traditional credit market by offering an alternative to credit cards and personal loans. While BNPL is primarily a short term financing tool, it challenges the dominance of credit cards, which often come with high-interest rates and fees.

However, traditional credit card companies are responding by introducing similar installment payment options. For example, American Express and Mastercard have launched their own BNPL services, aiming to capture some of the growing demand for flexible payment solutions.

Is BNPL a Sustainable Financial Trend?

Consumer Benefits and Drawbacks

The primary benefit of BNPL for consumers is the flexibility it provides. It allows individuals to manage their cash flow better by spreading out the cost of purchases over time. This can be particularly useful for large purchases such as electronics, furniture, and even travel. BNPL can also help consumers avoid the high interest rates of traditional credit cards.

However, there are significant drawbacks. If consumers miss payments, they face late fees, and in some cases, they may be charged interest. There is also the risk of accumulating debt, especially for those who overuse BNPL and fail to budget effectively.

BNPL Impact on Financial Health

While BNPL offers convenience, it can have a negative impact on long-term financial health if not used responsibly. Studies have shown that many users of BNPL services do not fully understand the financial implications of missing payments. This can lead to higher levels of debt and damage to credit scores.

According to a report from the Consumer Financial Protection Bureau CFPB, BNPL is often used as a way to finance discretionary spending, which can lead to unnecessary debt accumulation.

Regulatory Challenges and Legal Concerns

The BNPL industry is largely unregulated, which has raised concerns among policymakers. Some experts worry that the lack of oversight could lead to consumer harm, as users may not fully understand the financial risks involved. Countries like the UK and Australia have already begun regulating BNPL services, requiring greater transparency and better consumer protection measures.

In the United States, the CFPB has begun investigating BNPL companies to assess their impact on consumer debt. It remains to be seen whether new regulations will be implemented, but it is clear that the industry will need to adapt to evolving legal standards.

The Future of BNPL in the Financial Ecosystem

The future of BNPL depends on several factors, including consumer behavior, regulatory changes, and the response from traditional financial institutions. If BNPL services continue to grow, they could become a permanent fixture in the global financial landscape. However, BNPL companies will need to address the concerns regarding consumer debt and the potential for overuse.

Alternatives to Buy Now Pay Later

Traditional Financing Options

For those who prefer more structured financial options, traditional credit cards and personal loans offer longer term repayment plans and higher borrowing limits. While these options come with higher interest rates, they may be more suitable for individuals who need to make larger purchases or those who want more time to repay.

The Role of Digital Wallets and Alternative Payment Systems

As BNPL grows in popularity, digital wallets like Apple Pay and Google Pay are offering alternative ways for consumers to manage payments and avoid debt accumulation. These platforms integrate BNPL like features and allow for flexible payment options, often with lower fees and greater transparency.

What is Buy Now, Pay Later BNPL?

BNPL is a payment option that allows consumers to make purchases and pay for them in installments, often without interest.

How do BNPL services work?

Consumers choose BNPL at checkout, split the payment into installments, and repay over a set period, typically with no interest if paid on time.

Is BNPL available for all purchases?

BNPL is commonly offered by many retailers, both online and in store, but not all businesses provide this option.

What are the benefits of using BNPL?

BNPL offers flexibility, allows consumers to manage cash flow, and often has no interest if paid on time.

Are there any fees for using BNPL?

There can be fees for late payments or missed deadlines, but if payments are made on time, there are usually no extra costs.

Can BNPL affect my credit score?

Missing BNPL payments may negatively affect your credit score, but timely payments typically do not impact it.

Is BNPL a safe option for consumers?

BNPL can be safe if used responsibly, but overspending and missing payments can lead to debt and fees.

How is BNPL different from credit cards?

BNPL usually involves interest free installments over a short period, whereas credit cards offer revolving credit with higher interest rates.

Can I use BNPL for large purchases?

Yes, BNPL can be used for both small and large purchases, but the provider may limit the total amount depending on your credit history.

Is BNPL popular among millennials?

Yes, BNPL is particularly popular with younger generations, especially millennials and Gen Z, due to its convenience and accessibility.

Conclusion

Buy Now Pay Later services have undeniably revolutionized the way consumers shop, offering flexibility and convenience. However, the sustainability of this trend remains a topic of debate. While BNPL provides immediate financial relief for many consumers, it also carries significant risks, including the potential for debt accumulation. To ensure its long term viability, both consumers and businesses must adopt responsible usage practices, and the industry as a whole may need to embrace more regulation to protect consumers. The future of BNPL will depend on how well it can balance the convenience it offers with the risks it introduces.