Introduction

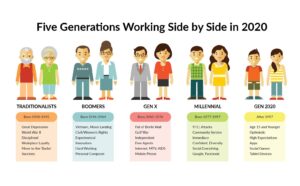

Personal banking has undergone rapid transformation over the past decade, driven by technology, customer expectations, and global connectivity. Yet, no demographic has influenced these changes as strongly as Gen Z and Millennials. Unlike Baby Boomers and Gen X, who were introduced to digital banking as an upgrade to traditional services, younger generations expect banking to be digital first, mobile centric, transparent, and personalized. They value ease of use, speed, low fees, and social responsibility as much as financial stability. Fintech, with its disruptive innovation, is at the center of this generational banking revolution. From mobile payments to AI driven budgeting, fintech companies are redefining what banking means for those born between the 1980s and early 2010s. This article explores how fintech is reshaping personal banking for Gen Z and Millennials, the key technologies leading the change, and what the future holds for this digitally native customer base.

Generational Characteristics

Millennials born 1981 to 1996

- Digital adopters but remember pre internet life.

- Saddled with student debt and high living costs.

- Value financial literacy, budgeting tools, and long term investments.

- Prefer mobile banking over branch visits but still care about customer service.

Gen Z born 1997 to 2012

- True digital natives: grew up with smartphones and instant access.

- Highly experience driven, seeking seamless, gamified financial tools.

- More entrepreneurial, with side hustles, freelancing, and crypto investing common.

- Expect real time, transparent, and personalized financial services.

Both groups prize convenience, low fees, sustainability, and digital first experiences pressuring banks to adapt.

How Fintech is Redefining Personal Banking

Mobile First Banking

Fintech apps are designed for smartphones as the primary platform, not branches. Digital only banks such as Revolut, Monzo, and Chime offer:

- Instant account opening.

- Real-time notifications.

- Fee-free spending abroad.

- Budgeting and categorization dashboards.

This convenience speaks to younger generations who prefer self service banking over waiting in queues.

Payment Innovation

Contactless payments, QR codes, and mobile wallets are not add ons they are the default for Gen Z and Millennials. Services like Apple Pay, Google Pay, Cash App, and PayPal dominate everyday transactions.

Fintech also enables peer to peer P2P transfers with zero friction, allowing instant money movement between friends, freelancers, or family members.

Personalized Financial Management

Fintech goes beyond transactions, offering personalized money management through AI driven tools.

- Budgeting apps like YNAB and Mint track spending in real time.

- Neobanks integrate savings goals, nudges, and round up investments.

- Machine learning predicts cash flow issues and alerts users in advance.

Younger users demand financial services that act as financial coaches, not just cash custodians.

Democratizing Investing

Millennials and Gen Z want accessible investing with low barriers. Fintech platforms provide:

- Fractional shares: Allowing investment with just a few dollars.

- Robo-advisors: Wealthfront, Betterment offering low cost, automated portfolios.

- Social trading: eToro, Public enabling users to copy strategies.

- Access to crypto trading and digital assets directly in apps.

This has normalized investing as part of everyday personal finance, not just something for the wealthy.

Embedded Finance & Super Apps

Fintech integrates banking into non financial platforms. For instance:

- Ride sharing apps offering driver loans and wallets.

- E commerce platforms offering Buy Now, Pay Later BNPL.

- Super apps like WeChat or Grab combining messaging, shopping, payments, and finance.

For Gen Z and Millennials, finance blends seamlessly with lifestyle apps.

Credit and Lending Reinvented

Traditional credit cards are being replaced by innovative lending models:

- BNPL platforms Klarna, Afterpay allow installment payments with no interest.

- AI powered underwriting offers fairer credit access to freelancers and gig workers.

- Alternative credit scoring considers rent, subscription, and utility payments.

This approach reflects how younger generations earn and spend money often outside traditional 9 to 5 employment.

Social and Ethical Banking

Fintech is tapping into values driven banking. Gen Z especially wants their money aligned with social impact:

- Green fintechs investing in sustainable projects.

- Transparency around fees and lending practices.

- Donation and micro investment options tied to causes.

This generation loyalty goes to brands that mirror their ethics.

Technology Driving the Change

- Artificial Intelligence AI powering personalization, fraud detection, and robo advisors.

- Blockchain enabling crypto wallets, stablecoins, and decentralized finance DeFi.

- APIs and Open Banking allowing fintech apps to integrate with traditional banks for seamless data sharing.

- Biometric Security fingerprint, face ID, and voice authentication making banking more secure.

- Cloud Infrastructure scaling neobanks and digital first institutions quickly and securely.

Challenges Facing Fintech and Younger Generations

- Overchoice and App Fatigue: Too many apps offering overlapping features.

- Security Concerns: Younger users are tech savvy but not always cautious.

- Debt Risks: BNPL and instant credit can encourage overspending.

- Regulation: Governments are catching up, creating compliance challenges.

- Financial Literacy Gap: Easy investing tools do not replace financial education.

Future Outlook What is Next for Gen Z and Millennials in Banking

- Hyper Personalization: AI driven offers, savings nudges, and financial coaching tailored to individuals.

- Crypto Integration: Wider acceptance of stablecoins and digital currencies.

- Sustainable Finance: Mainstream adoption of green banking products.

- Financial Inclusion: Serving freelancers, gig workers, and those without traditional credit histories.

- Metaverse Banking: Early experiments with virtual financial ecosystems for Gen Alpha and Gen Z.

Why Traditional Banks Must Adapt

Legacy banks risk losing an entire generation if they fail to:

- Deliver mobile first experiences.

- Lower fees and increase transparency.

- Partner with fintechs to provide innovative features.

- Embrace ESG environmental, social, governance finance.

Some banks have started hybrid approaches offering their own digital only brands or investing directly in fintech startups.

Compliance and Regulation

While fintech drives innovation, regulatory oversight is increasing. Gen Z and Millennials demand safe, trustworthy, and fair platforms. Expect growth in:

- Open banking standards.

- AI explainability rules for credit and lending.

- Crypto regulations defining stablecoin usage.

- Consumer protection for BNPL and micro lending.

FAQs

Why do Gen Z and Millennials prefer fintech?

Because it offers mobile first, low cost, and personalized banking experiences.

How does fintech make banking easier?

It enables instant payments, budgeting tools, and digital only accounts with no branch visits.

What role does fintech play in investing?

It democratizes investing with fractional shares, robo advisors, and crypto access.

How is fintech changing credit for young people?

Through BNPL, alternative credit scoring, and AI driven lending models.

Why is ethical banking important for Gen Z?

They want financial services that align with sustainability and social values.

What technologies power fintech banking?

AI, blockchain, APIs, biometric security, and cloud infrastructure.

What risks do younger generations face with fintech?

Overspending via BNPL, security concerns, and app fatigue.

Will traditional banks survive fintech disruption?

Yes, if they adapt with digital first, transparent, and customer centric services.

Is crypto part of personal banking for Gen Z?

Yes, regulated fintech apps are integrating stablecoins and crypto wallets.

What is the future of fintech for Gen Z and Millennials?

Hyper personalization, sustainable finance, and deeper lifestyle integration.

Conclusion

For Gen Z and Millennials, fintech is not just an option it is the default way of banking. By merging technology, values, and lifestyle integration, fintech has redefined personal banking into something mobile, transparent, personalized, and socially conscious. As fintechs and traditional banks compete for the loyalty of these generations, the winners will be those that blend innovation with trust, ethics, and long-term value. In 2025 and beyond, fintech is not just redefining banking it is redefining what it means to have a financial relationship altogether.